AI-Powered Financial Navigator: Transforming Access to Broker Services and Industry Knowledge for All Ages

The financial landscape is evolving rapidly, driven by technological advancements and an increasing demand for accessible, reliable information. Among the most significant innovations in this domain is the emergence of AI-powered financial navigators, designed to transform access to specialized financial insights and broker services. This article delves into how these platforms are revolutionizing the way users of all ages interact with financial information, ensuring a safe, educational, and intuitive experience.

The Need for Accessible Financial Knowledge

Financial literacy is crucial for individuals to make informed decisions about their money, yet traditional sources of financial information often fall short in terms of accessibility and comprehensibility. For many, especially those new to finance, the jargon and complexity of broker services and financial products can be daunting. This is where AI-powered financial navigators come into play, offering a bridge between complex financial concepts and the general user.

AI-Powered Chat Interfaces: A Game Changer

At the heart of this transformation is the AI-powered chat interface, a technology that combines natural language processing with vast databases of financial knowledge. These interfaces allow users to engage in conversational interactions, asking questions and receiving detailed, verified responses in real-time. The AI's ability to understand and adapt to user queries makes it an invaluable tool for financial education and navigation.

Verified Information for Enhanced Trust

One of the most significant advantages of AI-powered financial navigators is their commitment to providing verified information. Unlike traditional online sources, which may contain inaccuracies or outdated data, these platforms ensure that all content is cross-checked and validated. This feature is particularly crucial in finance, where misinformation can lead to significant financial losses or poor decision-making.

Educational Value for Users of All Ages

The beauty of AI-powered financial navigators lies in their versatility and adaptability to different user needs. Whether you are a seasoned investor, a student just starting to learn about finance, or someone looking to refresh your knowledge, these platforms offer tailored content. The educational value is immense, as users can explore a wide range of topics from basic financial principles to advanced investment strategies.

Child-Friendly Version for Secure Learning

Recognizing the importance of financial education from a young age, these platforms often include a child-friendly version. This version is designed to be safe and educational, with content that is both engaging and easy to understand. Parents and educators can rest assured that children are learning from reliable sources, fostering a foundation of financial literacy that will benefit them throughout their lives.

Empowering Seasoned Professionals

While the platforms are designed to be accessible to all, they also cater to the needs of professional financial advisors and brokers. These users can leverage the AI to stay updated on the latest market trends, regulatory changes, and industry best practices. The AI can provide insights and data analyses that help professionals make informed decisions and offer better advice to their clients.

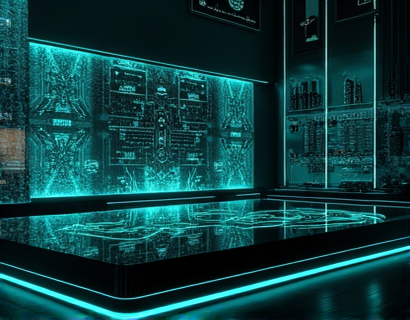

Intuitive User Interface

The success of AI-powered financial navigators hinges on their user interface. Designed to be intuitive and user-friendly, these platforms ensure that users can navigate through complex financial information with ease. The conversational nature of the chat interface makes the experience feel natural and less intimidating, encouraging users to explore and learn more.

Real-World Applications and Benefits

The practical applications of AI-powered financial navigators are vast. For individual investors, these tools can help demystify investment options, provide personalized recommendations, and track portfolio performance. For families, they offer a way to discuss and manage finances collectively, ensuring everyone is on the same page. In educational settings, teachers can use these platforms to create interactive lessons that bring financial concepts to life.

Case Study: Enhancing Financial Literacy in Schools

Consider a scenario where a middle school integrates an AI-powered financial navigator into its curriculum. Students can use the platform to learn about budgeting, saving, and investing through interactive modules. The AI provides real-time feedback and examples, making the learning process both engaging and effective. Over time, students develop a solid understanding of financial principles, equipping them for future success.

Challenges and Considerations

Despite the numerous benefits, the adoption of AI-powered financial navigators is not without challenges. Ensuring the accuracy and reliability of the AI's responses is paramount. Continuous updates and rigorous testing are necessary to maintain the highest standards of information quality. Additionally, privacy and security must be top priorities, especially when dealing with sensitive financial data.

Regulatory Compliance

Another critical aspect is compliance with financial regulations. These platforms must adhere to strict guidelines set by regulatory bodies to ensure that the financial advice provided is legal and ethical. This compliance not only protects users but also builds trust in the technology.

Future Prospects

The future of AI-powered financial navigators looks promising. As technology advances, these platforms will become even more sophisticated, offering deeper insights and more personalized experiences. The integration of additional features, such as predictive analytics and virtual reality simulations, could further enhance the learning and decision-making processes.

Conclusion

AI-powered financial navigators represent a significant leap forward in making financial knowledge accessible and understandable to everyone. By providing verified, intuitive, and educational content, these platforms empower users of all ages to make informed financial decisions. As the financial landscape continues to evolve, these tools will play an increasingly vital role in fostering financial literacy and stability.